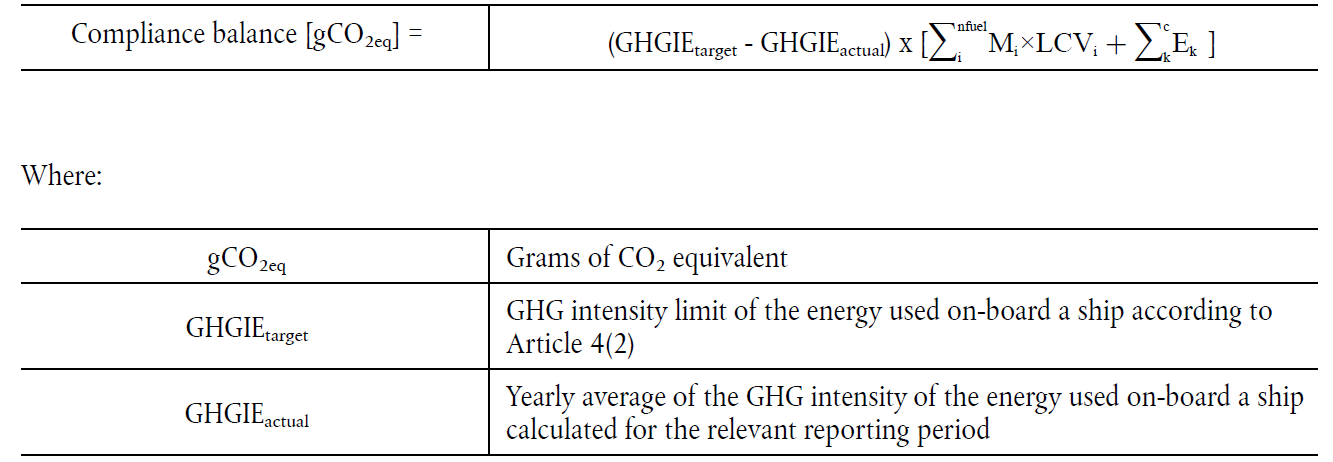

Compliance Surplus or Deficit is determined by comparing the target greenhouse gas (GHG) intensity value set for a reporting period with the actual GHG intensity value averaged over the energy used onboard during that period. A Compliance Surplus occurs when the actual GHG intensity is lower than the target value, indicating an excess compliance beyond the requirement. Conversely, a Compliance Deficit arises when the actual GHG intensity exceeds the target value.

It is used to assess whether the ship has met or exceeded the regulatory requirements for GHG emissions intensity during that reporting period.

Compliance balance for ship wrt GHG Intensity of energy used is estimated as per Annex IV

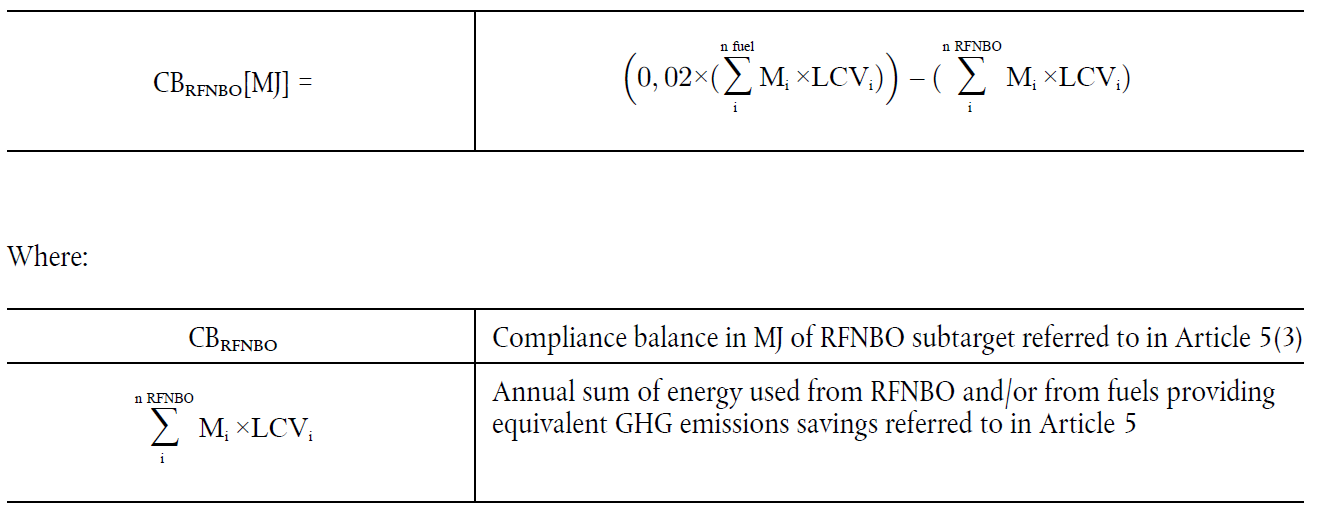

Compliance balance for ship wrt to sub targets of RFNBOs as defined in Annex IV

Compliance Surplus or Deficit remains valid into the following year, especially when considering compliance mechanisms such as Banking and Borrowing. Banking refers to carrying forward a Compliance Surplus from one reporting period to offset future deficits, while borrowing allows a company to cover a Compliance Deficit by borrowing against future Compliance Surpluses. However, Pooling for Compliance balance is limited to the reporting period only.

In the event of a change in company ownership, any existing Compliance Surplus (Banking) or Deficit (Borrowing) remains associated with the ship. Therefore, it is crucial for the involved parties to establish prior agreements to manage these compensatory matters effectively.

We’d like to hear from you!

Contact us today and one of our experienced team

members will connect with you soon.

Stay Connected

Subscribe to our newsletter to get company updates on your mailbox.