Levelling the Ocean: Global Carbon Pricing for a Shared Climate Future

Executive Snapshot: GHG Reduction Strategy Through the GFI Lens

In a landmark move to curb the maritime industry’s contribution to climate change, the International Maritime Organization (IMO) introduced a goal-based fuel standard during its 83rd session of the Marine Environment Protection Committee (MEPC 83). Central to this regulation is the implementation of a global measure targeting ships of 5,000 gross tonnage (GT) and above, requiring them to calculate and report their annual Greenhouse Gas Fuel Intensity (GFI) a metric defined as the amount of CO₂-equivalent emissions per megajoule (gCO₂eq/MJ) of energy consumed.

By accounting for all fuel types and onboard energy sources—weighted according to their energy contribution and specific greenhouse has (GHG) intensity—the Greenhouse Gas Fuel Intensity (GFI) calculation incentivizes the adoption of low- and zero-carbon fuels, such as green ammonia, hydrogen, and other alternative energy sources. Ships that achieve lower GFI scores not only demonstrate stronger environmental compliance but may also be eligible for financial incentives, providing a dual benefit of sustainability and economic efficiency.

Key Takeaways

- Rising Regulatory Burden: The cumulative effect of upcoming IMO GFI regulatory frameworks and existing EU ETS + FuelEU Maritime is expected to substantially increase operating costs across the shipping industry over the next decade.

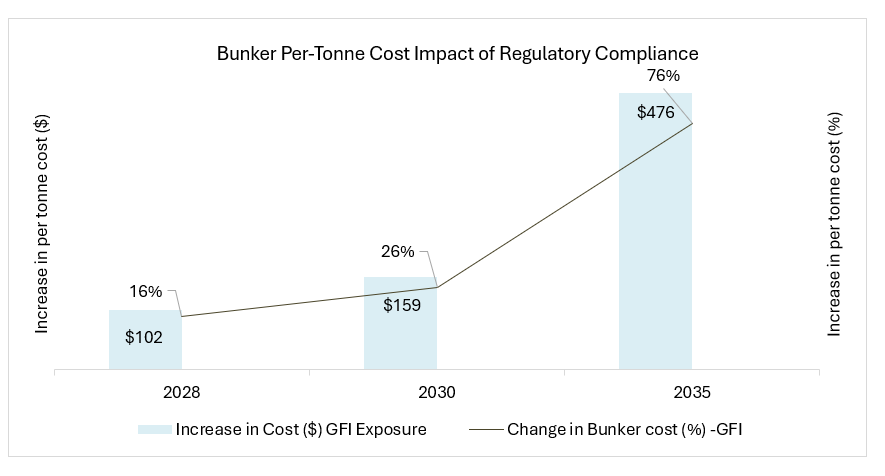

- Forecasted Bunker Cost Surge: Fleets continuing fossil fuels will incur additional costs under IMO GFI, projected to rise by 16% by 2028, 26% by 2030, and 77% by 2035, underscoring the urgent need for proactive mitigation as the industry transitions into the GFI and Net Zero regulatory framework.

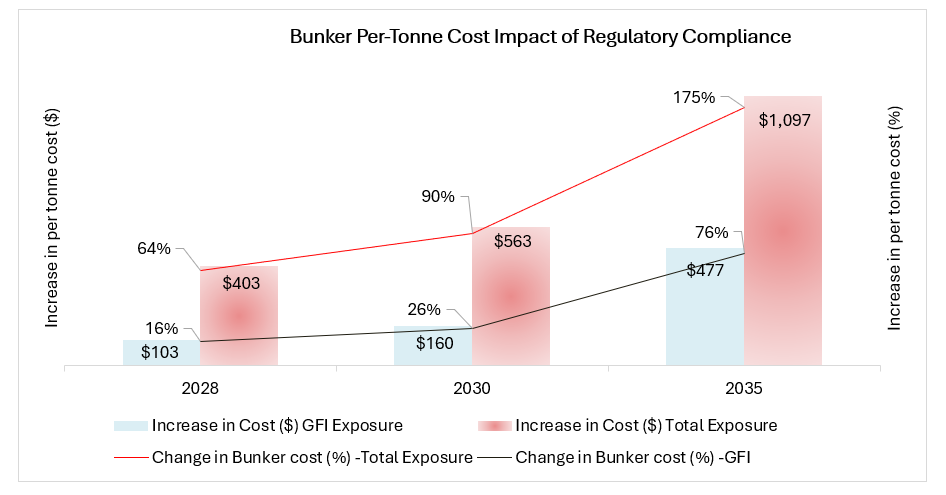

- EU Voyage Cost Escalation: Bunker expenses for the reference within EU voyages projected to increase by 64% in 2028, 90% in 2030, and 175% in 2035, leading to a significant reduction in net voyage earnings due to triple exposure, incorporating EU ETS, FuelEU Maritime, and GFI compliance costs.

- GFI Evolution and Scope Expansion: While GFI and FuelEU Maritime may align in their initial phases, the GFI regulation will become progressively stricter post 2030, expanding its scope to influence global trade routes and non-EU port calls.

- Predictable Decarbonization Pathway: The IMO’s fixed annual GFI target reduction rate of 12.3% offers a clear and predictable decarbonization trajectory, enabling stakeholders to incorporate compliance planning into their long-term strategies and investment models.

- Accelerating Global Impact of IMO GFI Framework: Once IMO GFI two tier framework is adopted this year, Emission cost implications will transition from existing EU routes to worldwide trading thereby requiring a Global Decarbonization and Emission compliance strategy.

- Impact of Fuel Offsetting Using Biofuels: As we offset the fuel penalty, there is a marginal decline in CO₂ deficits under the GFI scheme. Tier 2 deficits appear manageable, but Tier 1 remains significantly stringent.

GFI Compliance Framework: Regulatory Pathway for Two-Tier Balancing System

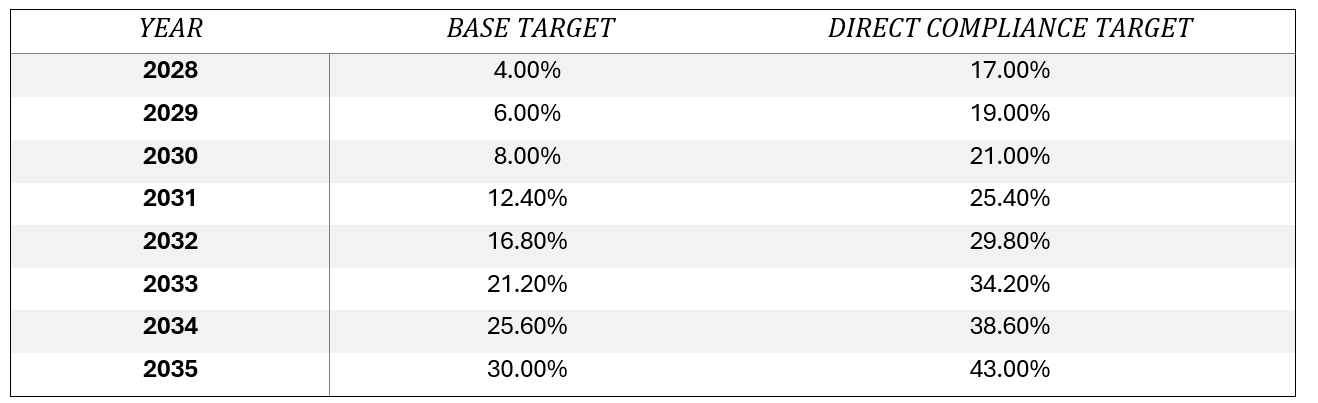

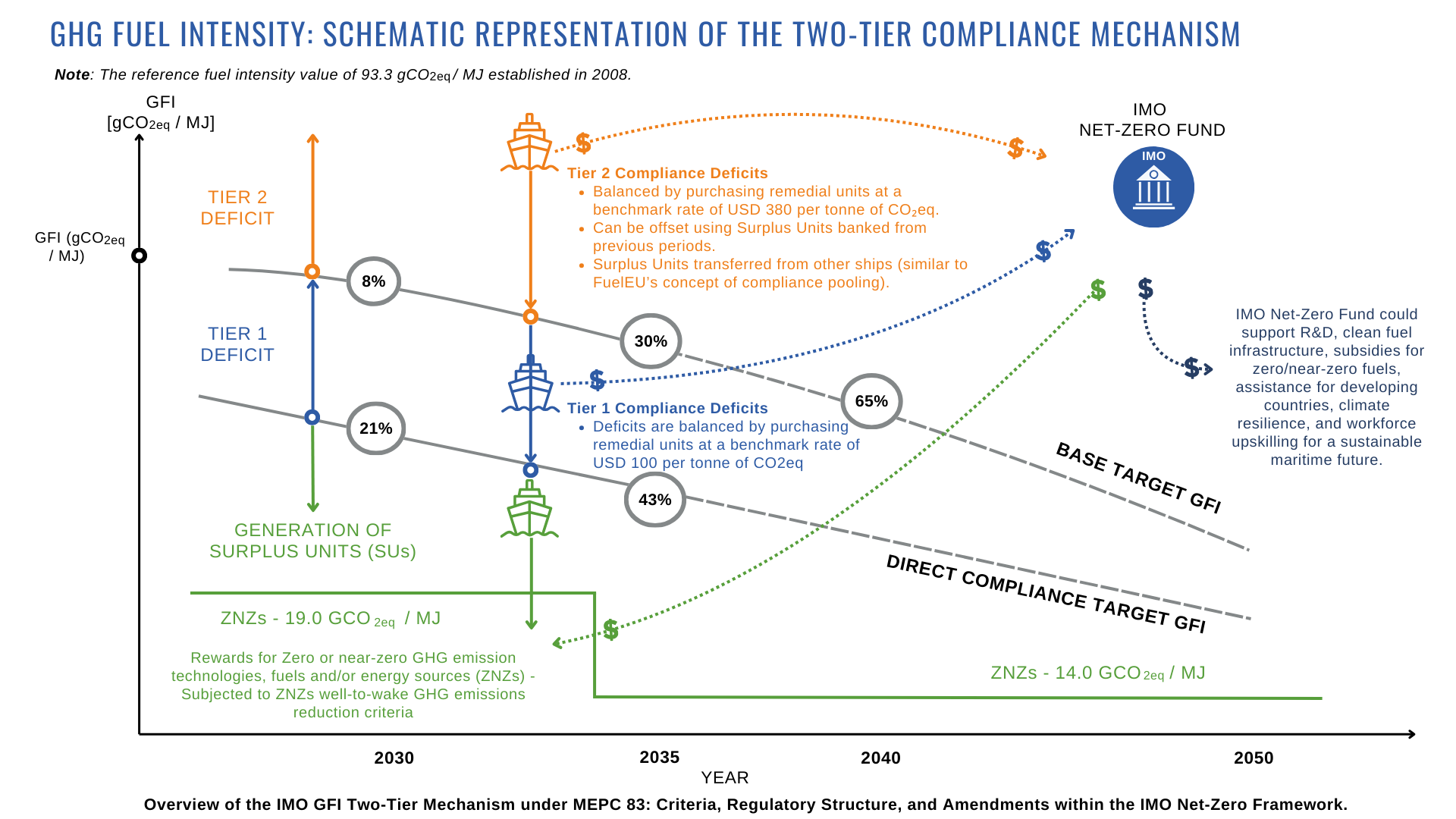

The IMO’s MEPC 83 session introduced a global regulation for reducing greenhouse gas (GHG) emissions through a goal-based fuel standard. The attained GFI compared against progressively stricter targets (Two-tier benchmarks) based on the 2008 fleet baseline (93.3 gCO₂eq/MJ), with reduction factors applied annually.

Two-Tier GFI-Linked Pricing System

To enforce compliance with GFI targets, MEPC 83 introduced a dual-tier pricing mechanism for emissions exceeding the allowable GFI threshold:

- Tier 1 Deficit: Applies when a ship’s GFI exceeds the Direct compliance target (DCT) but remains below the base limit. The ship must purchase Tier 1 remedial units priced at $100 per ton CO₂eq.

- Tier 2 Deficit: Applies when a ship’s GFI exceeds both the Direct compliance target and the Base Target. The ship must either purchase Tier 2 remedial units priced at $380 per ton CO₂eq or use previously banked Surplus Units, or trade credits with other compliant ships.

– If it emits more than the Base or DCT → it has a compliance deficit.

– If it emits less than the DCT → it earns Surplus Units (credits) with validity 2 years.

If a vessel fails to meet the Base target, the total penalty under the GFI compliance is calculated as: Penaltyᵢ ($) = (ΔGFIᵢ × Eᵢ × 380) + (GFI(Base) − GFI (DCT)) × Eᵢ × 100

If a vessel meets the BT but fails to achieve the DCT, the penalty is calculated as rate: Penaltyᵢ ($) = ΔGFIᵢ × Eᵢ × 100

- ΔGFIᵢ: Difference between the reference (target) GFI and the attained GFI and in year i

- Eᵢ: Total energy consumption (in MJ) during year i

- GFI(Base): The reference GFI for the year I to comply with Tier 2

- GFI(DCT): The reference GFI for the year I to comply with Tier 2

Ships with GFI values below the target earn Surplus Units, which can be banked or traded, promoting efficiency and creating a carbon market within the maritime sector.

Economic Impact: Establishes a carbon market within shipping, where low emitters profit and high emitters in noncompliance of regulation will be compelled to pay more.

IMO’s Financial Incentives for Zero and Near-Zero Emission Fuels

Under the IMO MEPC 83 framework, ships that adopt Zero or Near-Zero GHG (ZNZ) emission fuels or technologies will be eligible for financial rewards, promoting early uptake of cleaner solutions.

A GFI (Greenhouse Gas Fuel Intensity) threshold used to determine eligibility:

- ≤ 19.0 gCO₂eq/MJ until 31 December 2034

- ≤ 14.0 gCO₂eq/MJ from 1 January 2035 onward

These thresholds define what qualifies as ZNZ. The actual reward mechanisms and amounts will be decided by MEPC no later than 1 March 2027, with a review every five years. The initiative supports the transition to sustainable marine fuels by linking economic benefits to environmental performance.

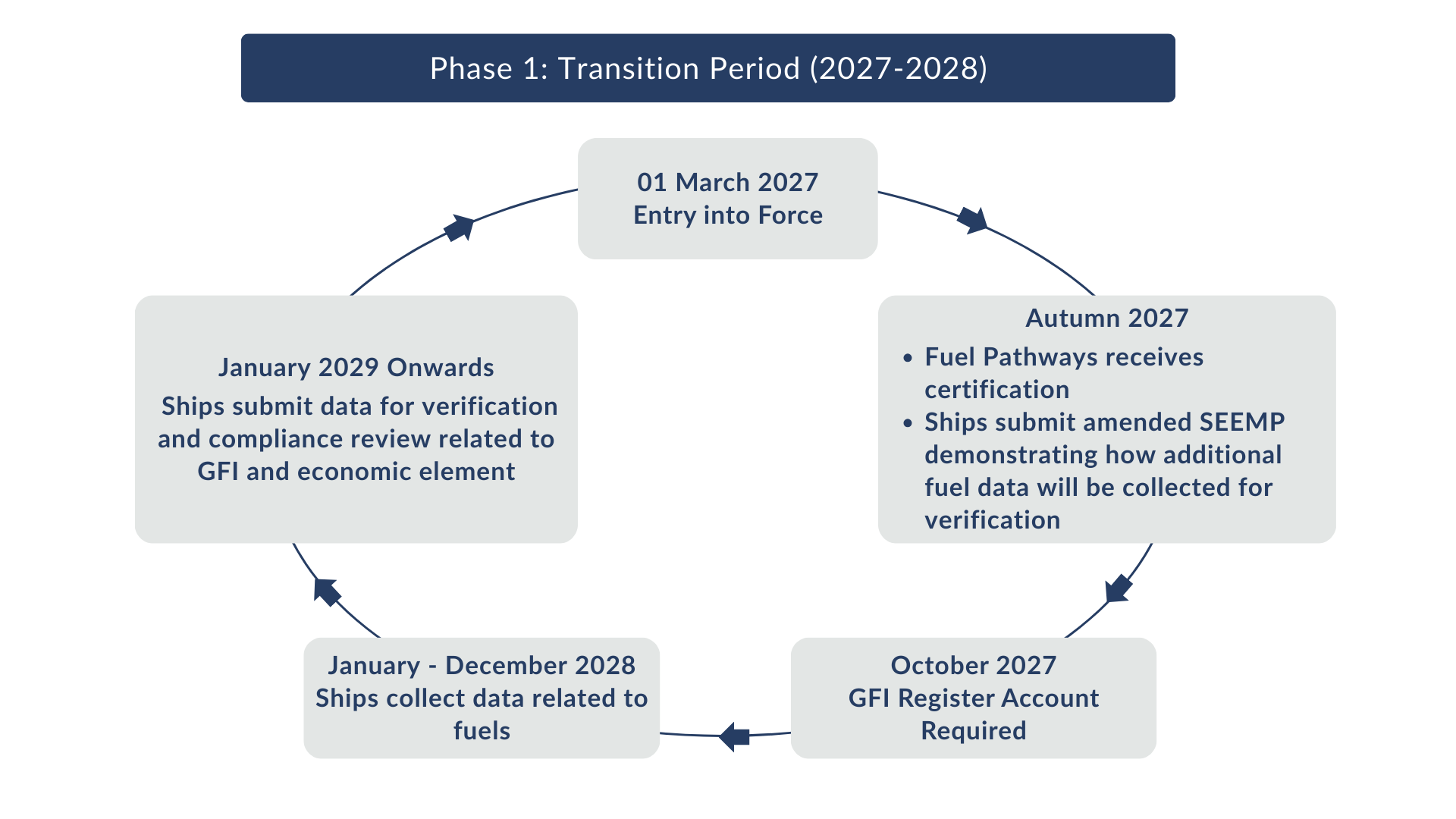

IMO GFI – Regulatory Timelines: Regulation kicks in from 1st Jan 2028

Navigating the Overlap: FuelEU Maritime vs IMO GFI Compliance

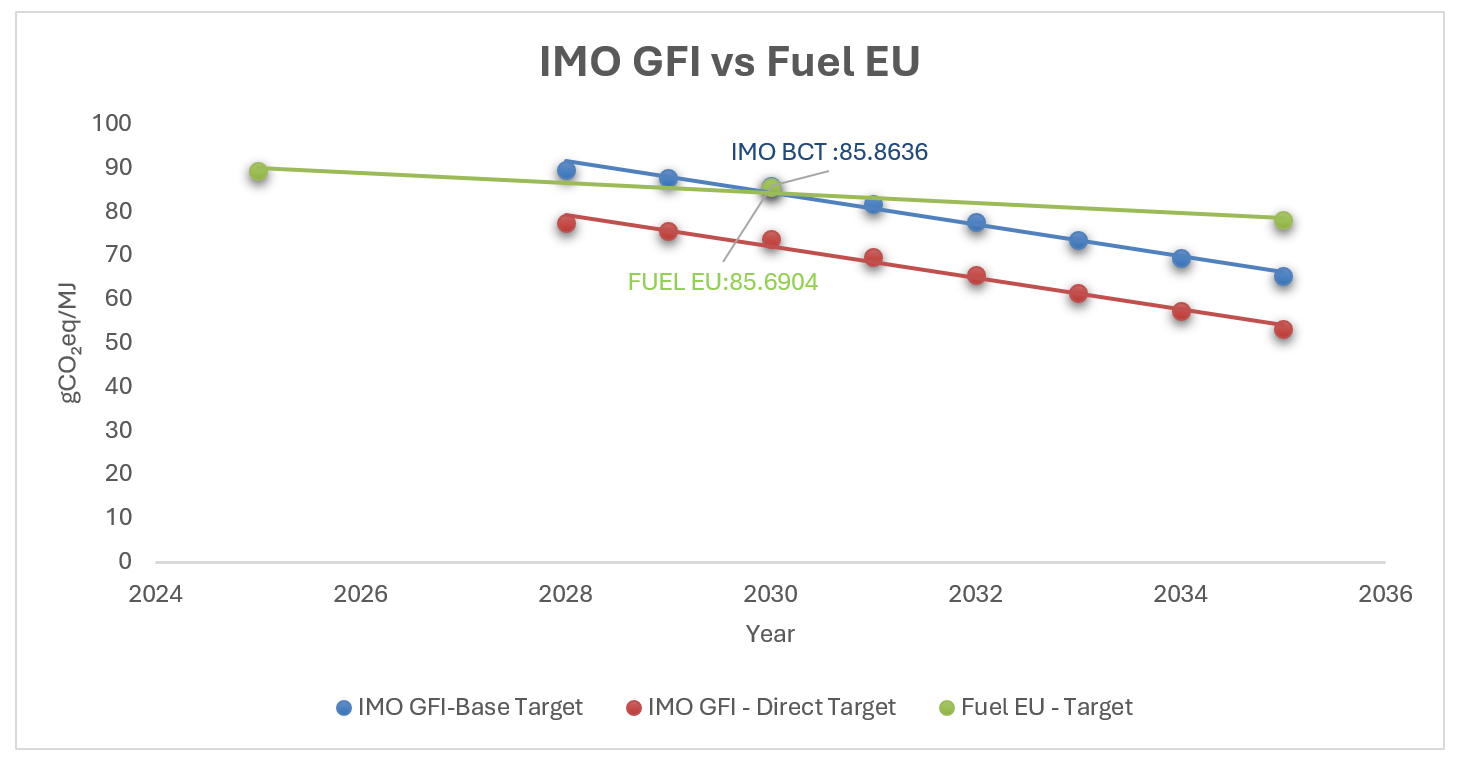

- IMO GFI and FuelEU overlap: Both FuelEU Maritime and the IMO’s GFI framework begin by setting reduction targets for GHG intensity in a comparable range. This can initially make compliance similar across both systems.

- GFI Framework Stringency Over Time: From 2028 onwards, ships must meet progressively stricter Direct and Base Compliance targets, derived from the 2008 baseline of 93.3 gCO₂eq/MJ.

- GFI – BT overtakes FuelEU Compliance: After 2030, ships that meet the IMO GFI Base Target (BT) are expected to automatically comply with FuelEU requirements, or at least have significantly lower FuelEU exposure for a proposed EU voyage.

- Consistent Annual Reduction – 12.3%: Both the BT and DCT follow parallel linear trajectories, showing an annual reduction of 12.3% from the GFI 2008 reference. The difference between them remains constant, indicating a uniform tightening of compliance standards each year.

Industry Commercial Impact of Regulatory Compliance

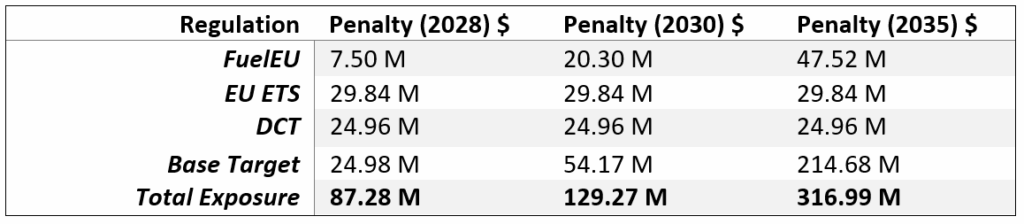

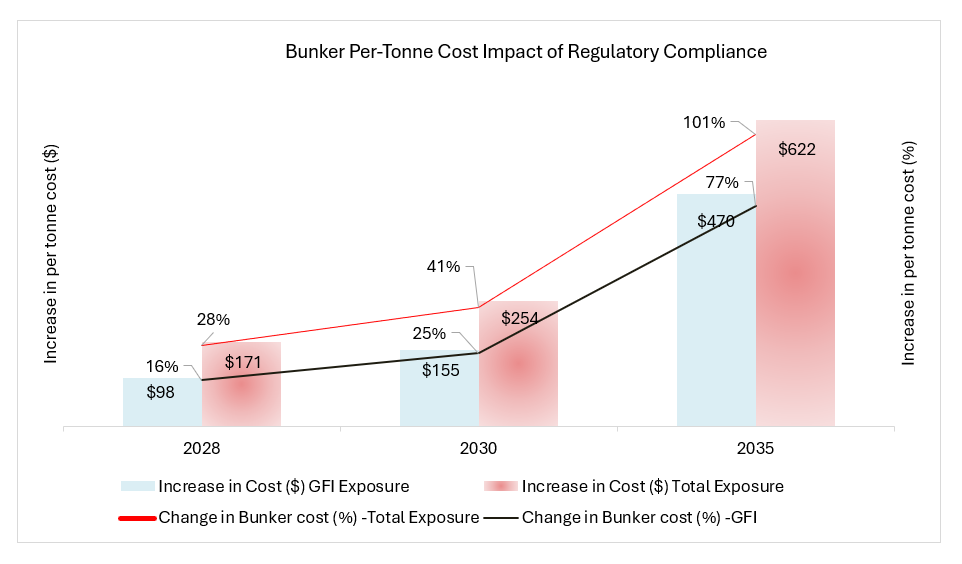

Case 1: Impact of GHG Reduction Measures on Tanker Fleet-World Wide.

In 2024, the reference fleet consisting of 100 modern tankers recorded a total fuel consumption of 614k MT. This analysis outlines the additional cost per tonne of fuel resulting from compliance with the three key regulatory frameworks: IMO’s GFI, the EU Emissions Trading System (EU ETS), and FuelEU Maritime.

Fuel Consumption (MT): HFO: 460k // LFO: 22.5k // LSMGO: 132k.

The applicable consumptions for EU and Non-EU related voyages are considered, respectively.

For this case study, EUA rates are assumed to remain fixed over the years, based on the premise that they are insulated from market volatility. For the analysis, the per tonne bunker costs are considered as follows: HFO at $600, LFO at $710, and LSMGO at $750.

Key Observations:

- Total Emissions Exposures are expected to increase sharply by approximately 28% in 2028, 41% in 2030, and a staggering 101% by 2035 if Vessel continue using Fossil fuels as bunkers.

- Under the IMO Net Zero framework, even vessels calling at ports outside the EU will experience increased costs, as these regulations represent a globally enforced levy. Further clarity and detailed cost implications are anticipated following discussions scheduled for October.

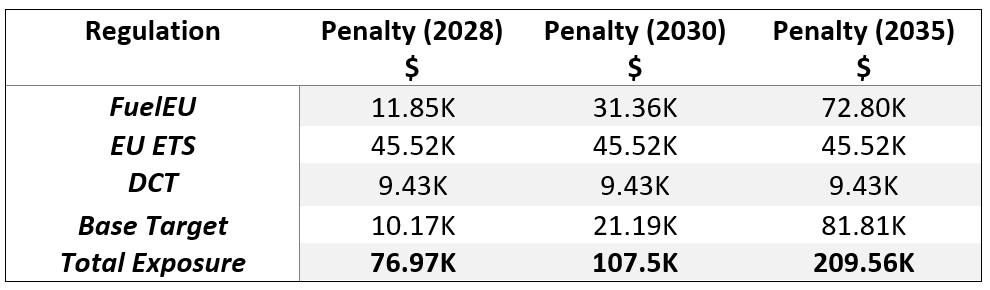

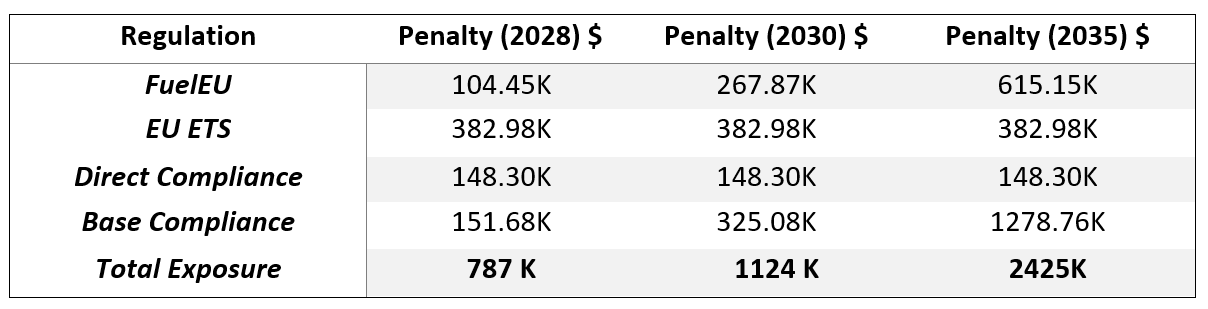

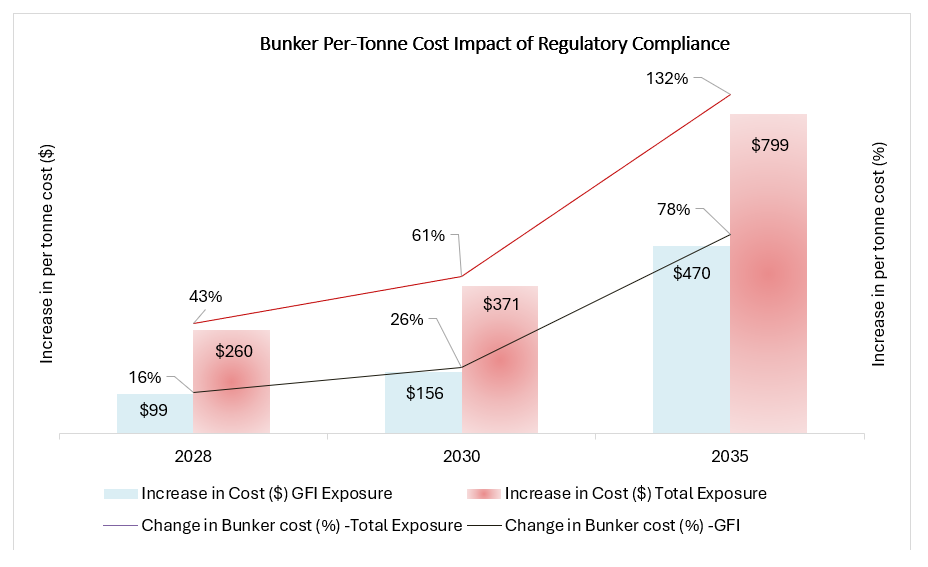

Case 2: Impact of New GHG Reduction Measures on an EU – EU voyage.

We examine a point-to-point EU voyage (Barcelona ⚓ Sarroch ⚓ Port-Jérôme) by a Handy Tanker vessel. This routing ensures that the vessel remains entirely within the EU regulatory jurisdiction throughout the duration of the voyage.

The total fuel consumption for this voyage is as follows: HFO: 155.2 Mt // LSMGO: 35.9 Mt

For this case study, EUA rates are assumed to remain fixed over the years, based on the premise that they are insulated from market volatility. For the analysis, the per tonne bunker costs are considered as follows: HFO at $600, LFO at $710, and LSMGO at $750.

The graph above illustrates the increase in per-tonne cost when considering the GFI in isolation, as well as in combination with other regulations such as FuelEU, EU ETS, and the IMO Net Zero Framework. It is evident that in the coming years, the GFI will have a growing impact on total exposure, leading to an overall increase in fuel costs.

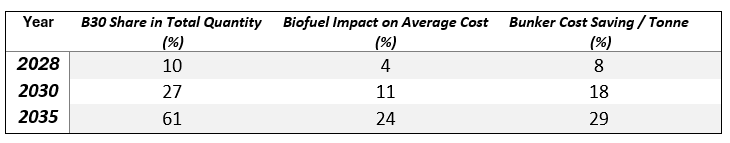

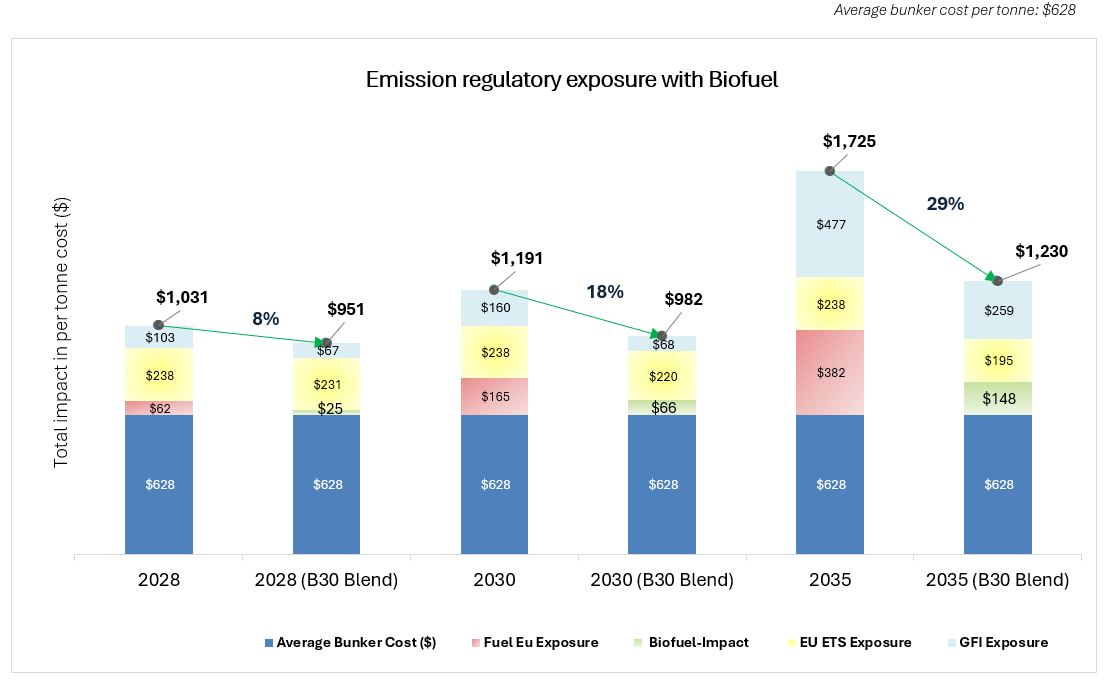

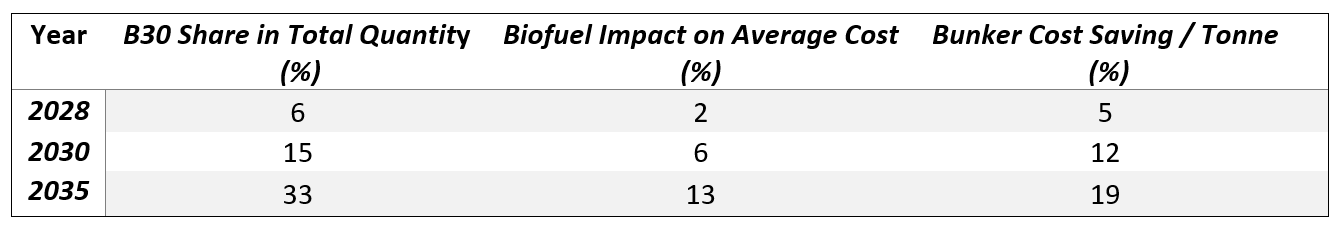

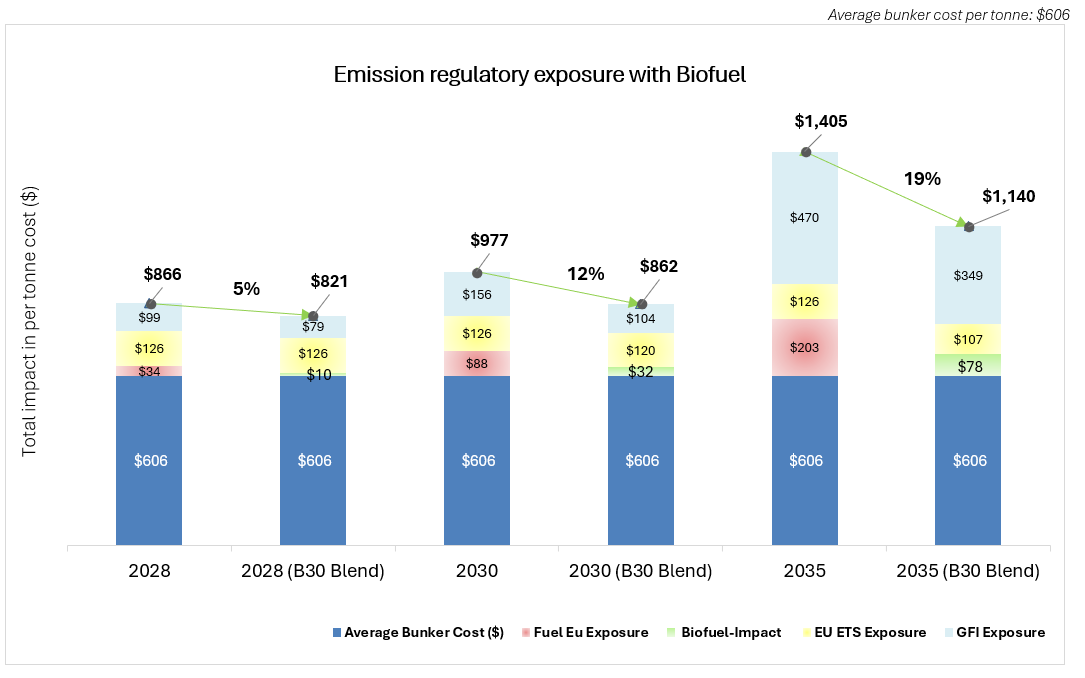

Exposure Under Biofuel Blends – B30

This analysis aims to offset the fuel penalty associated with Bio-Diesel (B30) blends by examining their effect on total exposure. A comparison is made between the change in total exposure and the increase in bunker costs resulting from the use of biofuels.

The initial fuel composition for this voyage is as follows: HFO: 155.2 Mt // LSMGO: 35.9 Mt

For this case study, EUA rates are assumed to remain fixed over the years, based on the premise that they are insulated from market volatility.

For the analysis, the per tonne bunker costs are considered as follows: HFO at $600, LFO at $710, and LSMGO at $750. The E value for B30 is considered as 9.2 gCO₂eq/MJ., and the cost of B30 is assumed to be $850 per tonne.

Insights – While we attempt to offset FuelEU, even with an increase in total bunker costs, we observe that use of Biofuel Blends offset marginally reduces the GFI impact from 8% in 2028 to 29% in 2035. It may help us reach the base target, but the DCT remains a significant challenge.

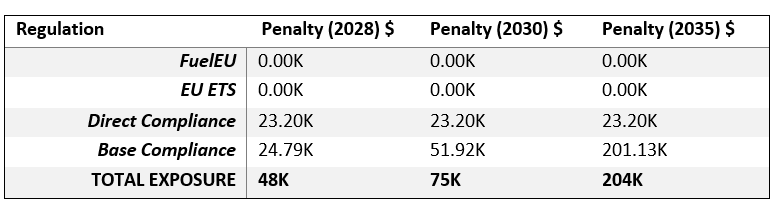

Case 3: Impact of New GHG Reduction Measures on an EU – Non-EU voyage.

We examine a round voyage undertaken by a long-range Tanker vessel (Rotterdam ⚓ Mina Al Ahmadi ⚓ Rotterdam), offering a representative example of mixed trade routes subject to both regional and international regulatory oversight.

The total fuel consumption for this voyage is as follows: HFO: 2913 Mt // LSMGO: 121 Mt

The applicable consumptions for EU related voyages are considered, respectively.

For this case study, EUA rates are assumed to remain fixed over the years, based on the premise that they are insulated from market volatility. For the analysis, the per tonne bunker costs are considered as follows: HFO at $600, LFO at $710, and LSMGO at $750.

Exposure Under Biofuel Blends – B30

This analysis aims to offset the fuel penalty associated with Bio-Diesel (B30) blends by examining their effect on total exposure. A comparison is made between the change in total exposure and the increase in bunker costs resulting from the use of biofuels.

The initial fuel composition for this voyage is as follows: HFO: 2913 Mt // LSMGO: 121 Mt

The applicable consumptions for EU related voyages are considered, respectively.

For this case study, EUA rates are assumed to remain fixed over the years, based on the premise that they are insulated from market volatility.

For the analysis, the per tonne bunker costs are considered as follows: HFO at $600, LFO at $710, and LSMGO at $750. The E value for B30 is considered as 9.2 gCO₂eq/MJ., and the cost of B30 is assumed to be $850 per tonne.

Insights – While we attempt to offset FuelEU, even with an increase in total bunker costs, we observe that use of Biofuel Blends offset marginally reduces the GFI impact from 5% in 2028 to 19% in 2035. It may help us reach the base target, but the DCT remains a significant challenge.

Case 4: Impact of New GHG Reduction Measures – Non-EU – Non-EU Voyage.

In this case study, we analyse a Non-EU to Non-EU voyage conducted by the medium vessel (Haldia ⚓ Singapore ⚓ Brisbane). All port calls occur outside the European Union, making this case relevant for evaluating the global implications of frameworks such as IMO Net Zero and the GFI, independent of EU-specific mandates.

The total fuel consumption for this voyage is as follows: HFO: 395.37 Mt // LSMGO: 75.771 Mt

For the analysis, the per tonne bunker costs are considered as follows: HFO at $600, LFO at $710, and LSMGO at $750.

The impact of the IMO GHG reduction framework lies in creating equal obligations across all regions, rather than limiting them to voyages associated with EU port calls.

Roadmap Ahead

IMO GFI can be regarded as a global counterpart to the FuelEU Maritime regulation, as both share methodological similarities in calculating emissions intensity and compliance. However, when combined, these regulations may result in triple exposure to emissions-related costs. Without an initiative-taking transition to alternative, low-emission fuels, shipowners’ risk significant cost burdens fossil fuel premiums specifically due to IMO GFI for all voyages are projected to increase by a constant trend of 16% in 2028, 26% in 2030, and 76% by 2035, reference in our case study above.

Directive 2003/87/EC of the European Parliament and Council, under Article 3gg, requires the European Commission to review the EU ETS if the IMO adopts a global market-based measure for shipping emissions. Within 18 months of such adoption, the Commission must submit a report to the European Parliament and Council evaluating its impact, outlining:

- The measure’s alignment with the Paris Agreement.

- Its environmental integrity, and issues related to the coherence with EU ETS and that measure.

Where appropriate, the Commission may also propose legislative amendments to ensure alignment between the EU system and the IMO’s global scheme while avoiding any significant double burden on the maritime sector.

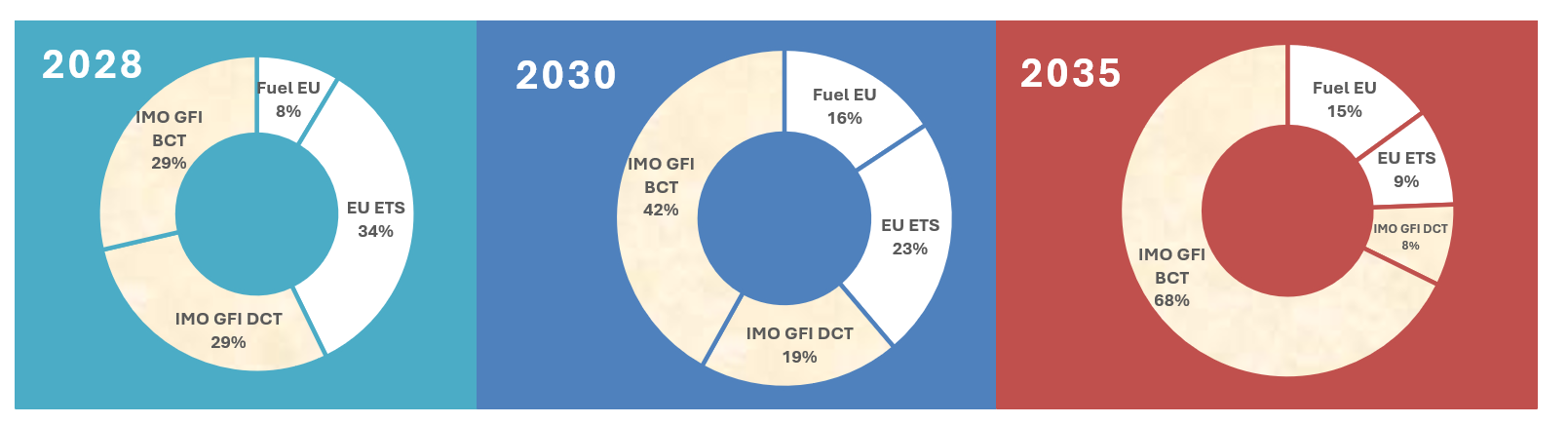

Summarized Emissions impact for WW Fleet depicts the increasing proportionate exposure of IMO GFI from 58% in 2028 to 76% in 2035.

With IMO GFI expected to be finalized in Q4/2025 by the industry, a delicate balance of multiple key metrics as below will decide on the decarbonization and Emission compliance strategy for the industry.

- Price, availability, quality and infrastructure of Sustainable fuels especially ZNZ.

- Market price for Surplus Units (IMO GFI)/Compliance surplus balance for FuelEU.

- Market prices and trends of EUA carbon rates.

- Smart deployment of incremental Emission control strategies.

- Efficient and Effective Emission and Performance Management solutions.

Emphasizing our key point that IMO GFI regulation from 1st Jan 2028 will transform the industry outlook from a Regional EU to a Global compliance level with an accelerating pace. Timely adoption to sustainable fuel and a comprehensive decarbonization strategy will be key to navigating the financial and regulatory complexities for all key maritime stakeholders.

We’d like to hear from you!

Contact us today and one of our experienced team

members will connect with you soon.

Stay Connected

Subscribe to our newsletter to get company updates on your mailbox.